35+ Home equity loan payment calculator

Most payment options include a deposit amount if the purchase if not made at once. Typically about 35 of home buyers who use financing put at least 20 down.

Can One Person Get 2 Home Loans At The Same Time If So What Are The Pros And Cons Of A Second Home Loan Such As For Tax Benefits Quora

Loan payment calculator.

. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options. This is the cost of the home minus the down payment. The length of the home equity loan is also referred to as the loan term.

This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. For draws taken under the interest-only repayment option your minimum monthly payment is equal to the finance charges accrued on the outstanding. Choosing fewer number of years will increase your monthly payment.

Loan Payment Calculator. 3599 APR and terms from 24 to 60 months. The most common home loan term in the US is the 30-year fixed rate mortgage.

The following table compares the cost of making no down payment a 3 down and a 5 down on your loan. This calculator will also figure your total monthly mortgage payment which will include your property tax property insurance and PMI payments. Home equity loan and HELOC guide.

The asset home is evaluated to affirm that it is. Enter your loan amount. 30-Year Fixed-Rate USDA Loan.

Equity Built 5 Years. Personal loans typically range from 2000 to 50000 though some providers offer loans as low as 1000 and as high as 100000. Home equity line of credit HELOC calculator.

Interest is the biggest source of a home loans costs with the typical borrower paying hundreds of thousands in interest over the life of a loan. As with a home equity loan you use your home as collateral. Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score down payment and length of your loan.

Loan Balance 5 Years. Examples of variable loans include adjustable-rate mortgages home equity lines of credit HELOC and some personal and student loans. Lets say you took a 30-year fixed USDA loan worth 250000 at 3 APR.

You get a lump sum upfront. For draws on a home equity line from Truist taken under the variable rate repayment option the minimum monthly payment is equal to 15 of the total outstanding balance. So naturally a lower interest rate can save you a lot of money on a home loan.

Follow these steps to calculate the monthly payment and total cost of a personal loan. Explore personal finance topics including credit cards investments identity. Enter your loan term.

The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. 35 of prospective home owners are intimidated by the deposit amounts for a property. Remaining P I payments.

The following table shows current 30-year mortgage rates available in Boydton. A Note on Private Mortgage Insurance. If you have an existing home loan you can save by refinancing to a home loan with a lower interest rate.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Full usage instructions are in the tips tab below. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. PMI typically costs from 035 to 078 of the loan balance per year. Los-doc loans rely on self-certification which is the personal approval that a borrower can offset the loan amount.

A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost. Unlike a mortgage or home loan its a flexible line of credit and you can use it only when you need to. Enter the amount you want to borrow.

You will only need to pay for mortgage insurance if you make a down payment of less than 20 of the homes value. For more information about or to do calculations involving any of these other loans please visit the Mortgage Calculator Auto Loan Calculator Student Loan Calculator or Personal Loan Calculator. Credit score ratings.

Loan payment calculator. Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of. Line of credit calculator.

You may be able to deduct the interest paid on a home equity loan or HELOC if the funds were. The number of years determines how long you will be paying on the loan until paid off. Personal loan rates currently range from 5.

Then the only monthly payment you have to pay is the interest. Those who pay at least 20 on a home do not require PMI but homebuyers using a conventional mortgage with a loan-to-value LTV above 80 are usually required to pay PMI until the loan balance falls to 78. When lenders consider you for a home equity loan or HELOC these criteria will count the most.

Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. How to use this personal loan calculator. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. 3599 APR and terms from 24 to 60 months. For example if we include down payment on that 70000 annual salary your home budget shrinks to 275000 with a down payment of 10 percent if youre aiming to.

Use our payment calculator above or use the below formula. Using our calculator on top lets estimate mortgage payments with the following example.

About Us Family First Funding

12205 Piney Meetinghouse Potomac Md 20854 Mls Mdmc2060328 Redfin

Average Down Payment For A House Here S What S Normal

Best Reverse Mortgage Services In Arizona Sun American

Average Down Payment For A House Here S What S Normal

Products Services Oak Tree Business Credit Union Credit Card Application Union

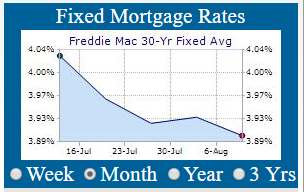

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Refinance Loans Family First Funding

12205 Piney Meetinghouse Potomac Md 20854 Mls Mdmc2060328 Redfin

6742 High Park Cir New Market Md 21774 Mls Mdfr2024708 Redfin

The Difference Between Banks And Credit Union Infographic Oak Tree Has Provided Lending Documents Forms And Disclo Credit Union Credit Union Marketing Union

8638 Arthur Hills Cir North Charleston Sc 29420 Mls 22016098 Redfin

8638 Arthur Hills Cir North Charleston Sc 29420 Mls 22016098 Redfin

How Does A Home Equity Loan Work What Are The Benefits Quora

Refinance Loans Family First Funding

If A Home Is Valued At 375 000 And Appraised At 355 000 And The Loan To Value Is 75 How Can I Calculate The Loan Amount Quora

Home Equity Oak Tree Business